Press Release

|November 17,2025Developers' Sales Surged To 11-month High In October, Propelled By Robust Demand For New Launches; Monthly Sales In The Core Central Region Are Highest In Over 18 Years

Share this article:

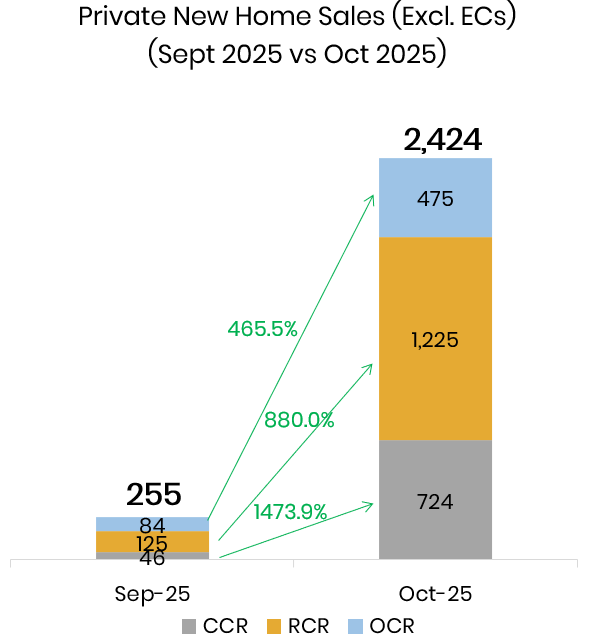

17 November 2025, Singapore - Developers' sales surged to an 11-month high in October, buoyed by strong demand for newly launched projects that reignited buying interest across the market. New private home sales came in at 2,424 units (ex. executive condos) in October, rising more than nine times from the 255 units shifted in September, and it the highest tally since 2,560 units changed hands in November 2024. On a year-on-year basis, sales were up by over three times from the 748 units transacted in October 2024.

Much of the momentum came from the Rest of Central Region (RCR) where there were two new launches - Penrith and Zyon Grand - in the month. The Core Central Region (CCR) and Outside Central Region (OCR) also each saw a new project launched, namely Skye at Holland and Faber Residence, respectively. All in, developers launched 2,233 new units during the month - up sharply from the 20 new units launched in September.

Source: PropNex Research, URA (17 November 2025)

The RCR led sales in October with 1,225 new homes sold - up from 125 units transacted in the previous month. This segment accounted for 50% of the new private homes sold in October. It is also the highest monthly new home sales in the RCR since 1,569 units were sold in November 2024. The top-sellers in this sub-market in October were Zyon Grand which sold 595 units at a median price of $3,038 psf, and Penrith where 446 units were sold at a median price of $2,791 psf (see Table 3). The two projects made up about 85% of the RCR new home sales in October. Looking at November, RCR sales are likely to trend lower, given that there will be only one new launch, the 347-unit The Sen in the month. Over the weekend, The Sen, near Beauty World sold 23% of its total units during its placement exercise.

The CCR put on a stellar showing in October, where developers sold 724 new homes - the highest monthly sales in the CCR since mid-2007 where the monthly developers' sales data were first published by the URA. The main driver of CCR sales was Skye at Holland which shifted 662 out of its 666 units at a median price of $2,949 psf. Meanwhile, recent launches also continue to move units - The Robertson Opus sold 18 units, while River Green and UpperHouse at Orchard Boulevard sold 11 and 10 units, respectively. There are no further CCR new launches till Q1 2026, where Newport Residences and River Modern may potentially hit the market.

Over in the OCR, 475 new units (ex. EC) were transacted in October, up from the 84 units sold in the previous month. The best-performing OCR project in the month was Faber Residence which shifted 348 units at a median price of $2,149 psf. This was followed by Canberra Crescent Residences - launched in August - which sold 36 units at a median price of $1,995 psf. The upcoming new condo launch in the OCR could be Narra Residences in Dairy Farm Walk in Q1 2026.

Meanwhile, developers sold 22 new EC units in October, trending higher than the 15 units transacted in September. Of these, Otto Place EC sold 21 units at a median price of $1,753 psf in October. Based on URA figures, there were only 53 units of unsold new ECs from launched projects, as at the end of October. The dwindling supply of unsold EC units bodes well for the new EC launches in 2026, starting with the 748-unit Coastal Cabana EC in Pasir Ris in early-2026.

Mr Kelvin Fong, CEO of PropNex said:

"The robust demand at new launches have powered developers' sales to an 11-month high in October. The four new projects that hit the market in the month all achieved impressive take-up rates at their launch weekends. The 666-unit Skye at Holland sold 99% of its units, Penrith moved 97% of its 462 units, while the 399-unit Faber Residence and the 706-unit Zyon Grand shifted 87% and 84% of their inventory during their launch weekend, respectively.

We have not seen four back-to-back launches garnering take-up rates exceeding 80% in recent memory. Furthermore, in the first 10 months of 2025, 10 new launches (ex. EC) have sold 80% or more of their units at launch, compared with just two launches in 2024. The strong showing underscores buyers' continued confidence in well-located and thoughtfully priced developments, as well as the resilient demand for private homes. We observe that most buyers remain discerning, leaning towards properties that are located near to the MRT station, have a relatively manageable price quantum, and are seen to offer a good value proposition.

Notably, the CCR witnessed its highest monthly new home sales since mid-2007 when the URA first published the monthly developers' sales data - highlighting the renewed appeal of prime, high-end homes as new supply comes on and market sentiment improves. We note that the median unit price gap between new non-landed homes sold in the CCR and that of the RCR has narrowed to 2.2% in October from nearly 27% in the previous month (see Table 1), which could make CCR new launches look attractive to some buyers.

The narrowing price gap came as transactions at new RCR launches helped to prop up the median unit price in October, while the CCR saw an 8.9% MOM decline in median $PSF price in October from September. That said, median prices are heavily influenced by the number of projects launched, the units sold, and transacted prices during the month. For instance, the month-on-month decrease in CCR median unit price in October partly had to do with a higher proportion of homes sold at higher prices in September; of the 45 caveated CCR non-landed private homes sold in September, 80% fetched unit prices of $3,000 psf and above, which contributed to a higher median price in that month. In October, 44% of new CCR units sold were priced at $3,000 psf or more, based on caveats lodged.

Table 1: Median transacted unit price ($PSF) of new non-landed private homes (ex. EC) by region, and price gap (%)

| CCR | RCR | OCR | CCR vs RCR | CCR vs OCR | RCR vs OCR |

Jan-25 | $2,538 | $2,725 | $2,424 | -6.9% | 4.7% | 12.4% |

Feb-25 | $3,211 | $2,606 | $2,382 | 23.2% | 34.8% | 9.4% |

Mar-25 | $2,989 | $2,635 | $2,218 | 13.4% | 34.8% | 18.8% |

Apr-25 | $3,242 | $2,913 | $2,253 | 11.3% | 43.9% | 29.3% |

May-25 | $3,255 | $2,678 | $2,254 | 21.5% | 44.4% | 18.8% |

Jun-25 | $3,252 | $2,733 | $2,272 | 19.0% | 43.1% | 20.3% |

Jul-25 | $3,311 | $2,492 | $2,266 | 32.9% | 46.1% | 10.0% |

Aug-25 | $3,125 | $2,858 | $2,140 | 9.3% | 46.0% | 33.6% |

Sep-25 | $3,252 | $2,562 | $2,065 | 26.9% | 57.5% | 24.1% |

Oct-25 | $2,962 | $2,898 | $2,149 | 2.2% | 37.8% | 34.9% |

MOM | -8.9% | 13.1% | 4.1% |

We expect developers to continue to adopt a calibrated pricing approach to driving sales momentum and attracting prospective buyers, including HDB upgraders. In particular, we note that about 91% of units sold at Faber Residence were priced at below $2.5 million (see Table 2), with a sizable portion of them at $1 million to <$2 million - a palatable price point for many buyers today. Meanwhile, nearly 60% of the sales at Penrith and Skye at Holland, and close to half of the sales at Zyon Grand were transacted for below $2.5 million. The attractive pricing and easing borrowing cost have collectively fueled the strong developers' sales in October.

Table 2: Proportion of sales at new launches in October by price range

Price range | FABER RESIDENCE | PENRITH | SKYE AT HOLLAND | ZYON GRAND |

$1 mil to <$1.5 mil | 23.1% | 0.4% | 0.0% | 5.2% |

$1.5 mil to <$2 mil | 42.7% | 29.6% | 26.0% | 16.1% |

$2 mil to <$2.5 mil | 25.1% | 28.9% | 32.2% | 27.9% |

$2.5 mil to <$3 mil | 7.5% | 11.9% | 11.6% | 19.0% |

$3 mil to <$3.5 mil | 1.7% | 19.7% | 10.9% | 13.6% |

$3.5 mil to <$4 mil | 0.0% | 9.4% | 8.8% | 5.2% |

$4 mil to <$5 mil | 0.0% | 0.0% | 6.2% | 11.9% |

$5 mil to <$10 mil | 0.0% | 0.0% | 4.4% | 0.8% |

$10 mil and above | 0.0% | 0.0% | 0.0% | 0.2% |

Total | 100% | 100% | 100% | 100% |

Proportion below $2.5 mil | 90.8% | 59.0% | 58.2% | 49.2% |

Local buyers accounted for a lion's share of the new non-landed private homes (ex. EC) sold in October, with Singapore PRs and Singaporeans making up 12% and 86.7% of the transactions. Foreigners (non-PR) contributed to 1.3% of the sales, with 31 transactions. They comprised 11 units at Zyon Grand, nine units at Skye at Holland, two each at Penrith and One Marina Gardens, and one each at LydenWoods, Meyer Blue, Nava Grove, Pinetree Hill, Promenade Peak, The Avenir, and The Robertson Opus.

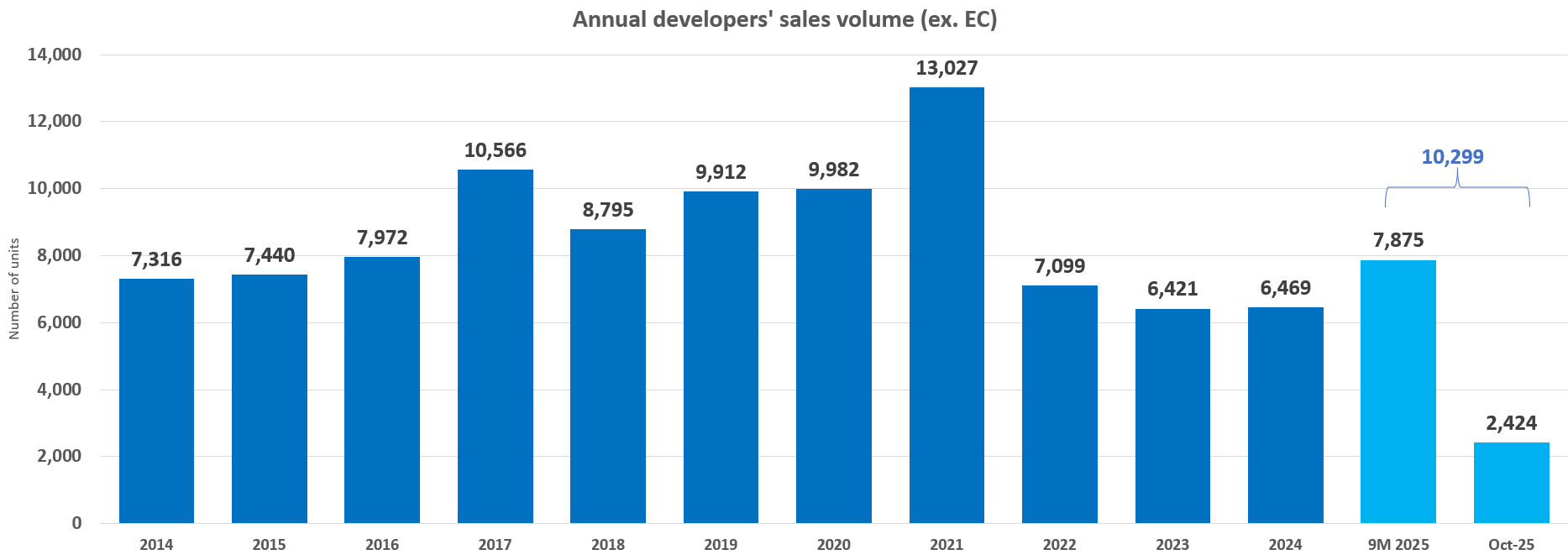

Chart 1: Annual new private home sales (ex. EC)

Including October's sales, developers have sold a total of 10,299 new homes (ex. EC) in the first 10 months of 2025 (see Chart 1) - the first time that developers' sales tipped over the 10,000-unit mark in nearly four years. With only one launch (The Sen) slated in November, we do not expect developers' sales to hit blistering pace in the final two months of 2025. However, the buying interest may pick up swiftly in Q1 2026 with more launches lined up."

Table 3: Top-Selling Private Residential Projects (ex. EC) in October 2025

S/N | Project | Region | Units sold in October 2025 | Median price in October 2025 ($PSF) |

1 | SKYE AT HOLLAND | CCR | 662 | $2,948 |

2 | ZYON GRAND | RCR | 595 | $3,038 |

3 | PENRITH | RCR | 446 | $2,791 |

4 | FABER RESIDENCE | OCR | 348 | $2,149 |

5 | PROMENADE PEAK | RCR | 44 | $2,993 |

6 | CANBERRA CRESCENT RESIDENCES | OCR | 36 | $1,994 |

7 | NAVA GROVE | RCR | 25 | $2,614 |

8 | SPRINGLEAF RESIDENCE | OCR | 19 | $2,252 |

9 | CHUAN PARK | OCR | 18 |

Explore Your Options, Contact Us to Find Out More!

Selling your home can be a stressful and challenging process, which is why

it's essential to have a team of professionals on your side to help guide you through the journey. Our

team is dedicated to helping you achieve the best possible outcome when selling your home.

Find Your Ideal Property: Take the First Step and Indicate Your Interest!More Property NewsDiscover New Launch Projects |